Net present value table

The syntax of the Excel NPV. Cumulative present value of 1 per annum Receivable or Payable at the end of each year for n years.

Nper Function Learning Microsoft Software Apps Excel

NPV analysis is a.

. Set a discount rate in a cell. Up to 3 cash back Assume that Traders cost of capital is 9 using the net present value table shows whether the new machine would at least cover its financial costs. Table A-2 Future Value Interest.

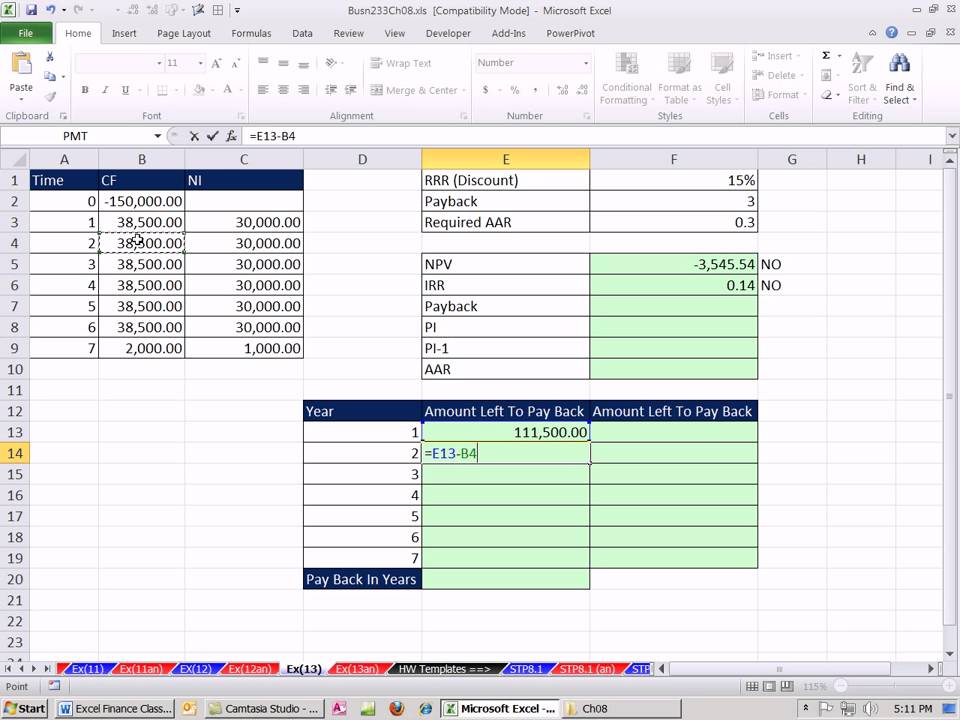

In this lesson we go through a great example of calculating NPV. Only the net present value example assumes and deducts the initial costs in year 0 of 150000. More specifically you can calculate the present value of uneven cash flows or even cash flows.

Net Present Value NPV most commonly used to estimate the profitability of a project is calculated as the difference between the present value of cash inflows and the present value. A discount rate selected from this. Workers Compensation Commission PO Box 1715 1333 Main Street Suite 500 Columbia SC 29202-1715 803-737-5700.

The present value discount factors are from a Present Value of 1 table. Table of Present Value Annuity Factor Number of periods 1 2 3 4 5 6 7 8 9 10 1 09901 09804 09709 09615 09524 09434 09346 09259 09174 09091. In Excel there is a NPV function that can be used to easily calculate net present value of a series of cash flow.

Present Value and Future Value Tables Table A-1 Future Value Interest Factors for One Dollar Compounded at k Percent for n Periods. N number of periods until payment or receipt. Net Present Value NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

The correct NPV formula in Excel uses the NPV function to calculate the present value of a series of future cash flows and subtracts the. A present value of 1 table states the present value discount rates that are used for various combinations of interest rates and time periods. Type NPV and.

1 The NPV function in Excel is simply NPV and the full formula. 1 r n Periods Interest rates r n. Present value of 1 that is where r interest rate.

Net Present Value - NPV. Calculate the net present value NPV of a series of future cash flows. Establish a series of cash flows must be in consecutive cells.

Net Present Value Understanding the NPV function. Example of how to use the NPV function. PRESENT VALUE TABLE.

CUMULATIVE PRESENT VALUE TABLE. We also explain what the Net Present Value is why it is calculated and how to explaininte. Net Present Value NPV is the value of all future cash flows positive and negative over the entire life of an investment discounted to the present.

The NPV function in Excel returns the net present value of an investment based on a discount or interest rate and a series of future cash flows. FVIF kn 1 k n.

Net Present Value Template Download Free Excel Template Excel Templates Templates Business Template

Product Cost Analysis Template Excel Analysis Templates Excel

Net Present Value Calculator Template Are You Looking For A Net Present Value Calculator Template In Excel Download T Templates Business Template Calculator

Capital Investment Models Net Present Value Investing Capital Investment Cost Accounting

Pv Function Learning Microsoft Excel Excel Templates

Future Value Annuity Due Tables Double Entry Bookkeeping Time Value Of Money Annuity Table Annuity

10 Inventory List Templates Word Excel Pdf Templates List Template Excel Templates Word Template

Pin On Money Make Save Spend

Roi Spreadsheet Example In 2022 Spreadsheet Spreadsheet Template Excel Templates

Chapter 2 Net Present Value Chapter Finance Investing

Random Numbers Chart Number Chart Words Chart

Pin On Net Office Component

Standard Normal Distribution Z Values N 25 Essay Tips Lean Six Sigma Normal Distribution

Formula For Calculating Net Present Value Npv In Excel Formula Excel Economics A Level

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

How To Car Loan Repayment Schedule In Excel Car Loans Loan Repayment Schedule Excel

Excel Finance Class 79 Investment Criteria Npv Irr Payback Aar Profitability Index Youtube Finance Class Investing Payback